Renters Insurance in and around Savannah

Savannah renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Savannah Renters!

Your possessions are valuable and so is their safety. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your furniture to your artwork. Overwhelmed by the many options? We have answers! Lynn Walker wants to help you evaluate your risks and help pick the appropriate policy today.

Savannah renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Renting is the smart choice for lots of people in Savannah. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance might cover smoke damage to the walls or water damage to walls and floors, that won't help you replace your possessions. Finding the right coverage helps your Savannah rental be a sweet place to be. State Farm has coverage options to match your specific needs. Thank goodness that you won’t have to figure that out alone. With empathy and fantastic customer service, Agent Lynn Walker can walk you through every step to help you build a policy that secures the rental you call home and everything you’ve invested in.

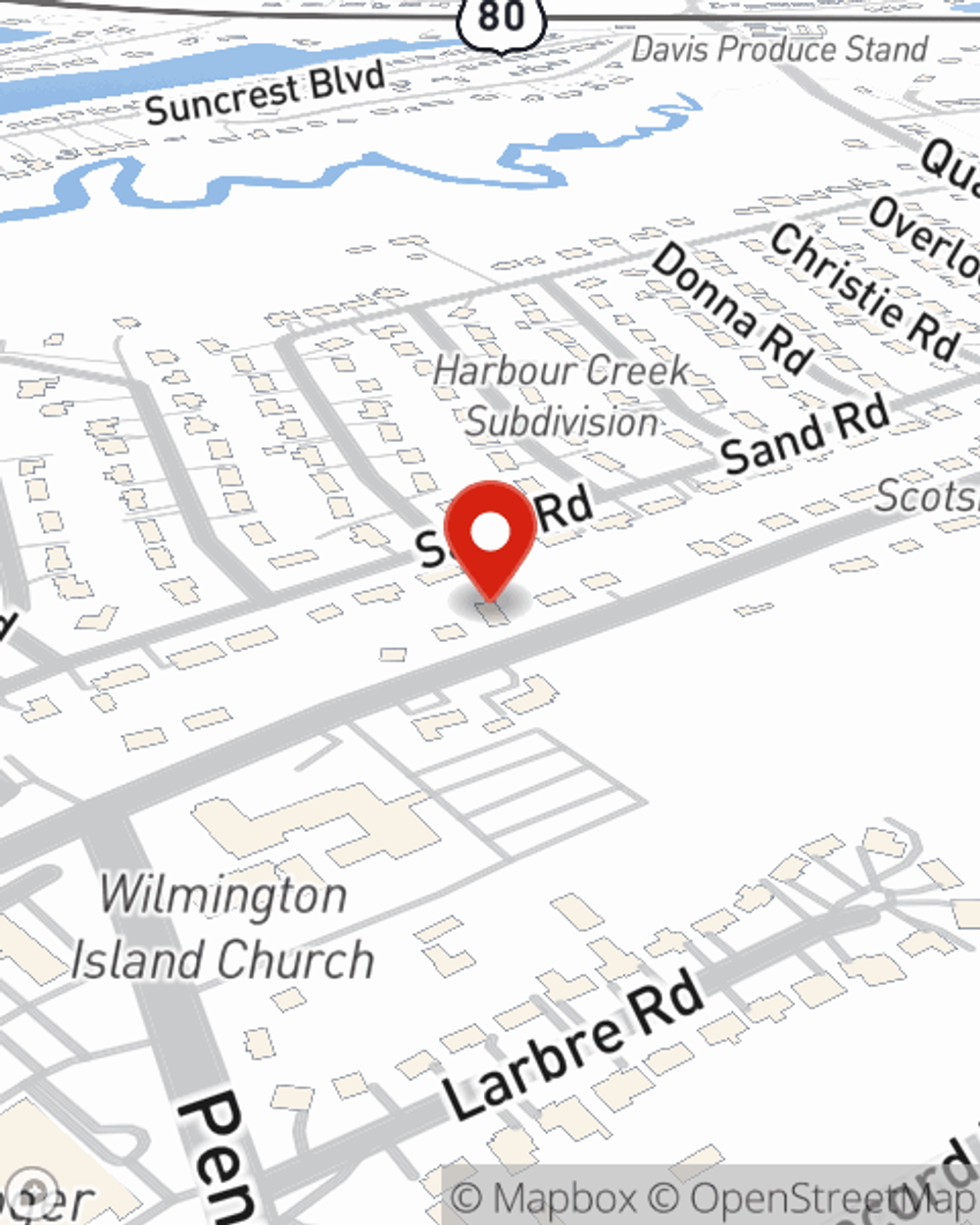

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Savannah. Get in touch with agent Lynn Walker's office to get started on a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Lynn at (912) 897-3333 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Lynn Walker

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.